CEO and investment market update

5 May 2023

What a year it’s been! Rising interest rates, rising cost of living, rising taxation and volatility across the global financial markets driven by various unsettling events and dynamics.

An economic backdrop like this does present challenges and has certainly had an impact on investors across the country.

So, where are we now and what does the future hold?

Financial Planning

The structuring and planning should always come first!

Careful attention is certainly required in respect of the various tax allowance changes announced in the recent Budget. There were many, but impacts across dividend allowance, corporation tax, income tax, capital gains tax and a frozen inheritance tax threshold, are a few of the key changes impacting many.

And while that may all sound like bad news, the ability to restructure wealth and place more effort into future planning is within our control.

Of course, it wasn’t all doom and gloom, the removal of the lifetime pensions allowance, the increased pensions annual allowance and the reduced tapered allowance and money purchase annual allowance, were all welcome changes.

The Finance Bill will be debated in Parliament before becoming the Finance Act and receiving Royal Assent. The new legislation will not fully come into force until later in the new tax year but will apply retrospectively from 6 April 2023.

Investments

In the investment arena, our clients and prospects have been asking several key questions which has often led to an enriched financial plan and increased comfort about their future. Questions such as:

- With obvious volatility and unsettled markets, should I stay invested?

- I haven’t invested yet but is now a good time to invest?

- How much risk am I currently taking and how much do I need to take to achieve my objectives?

These questions are becoming fairly frequent and central to our discussions with our clients.

Clearly, a lot depends on individual preferences, outlook, and objectives but it may help to understand that it is often ‘time in’ the markets rather than ‘timing’ the markets that matters.

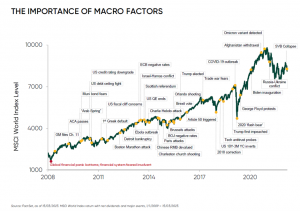

The graph below illustrates the longer-term movements of the financial markets. The takeaway here is that there is always short-term noise and we believe in looking through that and position our portfolios for the longer term in our quest to achieve positive real growth from the equity asset class.

One of our Investment Managers, Dale Smith, outlines some of the key considerations that may help with answering some of the questions above.

Investment market outlook

Considering the long-term investment outlook, we continue to focus on fundamentals and companies that have the ability within their business models to adapt to the market conditions that are presented. Over the last 12 months there have been various indiscriminate moves in markets, sectors and individual companies. Many changes are sentimental and reactionary without long term consideration of how individual companies are performing and adapting to the economic environment.

Corporate earnings so far remain supported, and the US consumer remains in good shape with a tight job market. While it’s anticipated that there may be some slowdown and pick up in unemployment at this stage, we don’t see a deep recession in the US but will continue to keep a close eye on economic developments. While inflation remains above central bank targets, we continue to focus on the companies that can build this into their business models and pass through the additional costings. On the equities allocation, we are focused on three main areas which drive returns over investment time frames. These are the share price, earnings, and dividends and the growth of the last two components.

We continue to actively engage with all our fund managers on both a routine and ad-hoc basis to monitor how they are positioned and the economic outlook as they see it. As the central banks continue to manage policy rates in the year ahead, we feel greater stability will be found in those companies that can consistently pass through costs.

We continue to review what drives short term sentiment in the markets against the potential for opportunity longer term. We remain overweight equities favouring active managers, who have been trimming and adding to positions when opportunities arise.

We also remain overweight in a pool of diversified real asset funds. Some of the underlying investments in the funds are assets with inflation linked contractual payments often backed by governments.

Our portfolios remain diversified across each asset class, sector and geography and our approach has the flexibility to take advantage of the changes in the markets throughout this period. We continue to focus on companies that have cash flow, strong earnings growth, have unique attributes, are hard for others to compete with, and have the ability to pass through increased inflation pressures.

As always, please do not hesitate to reach out to Dale Smith or your ASAM financial adviser should you wish to discuss any aspects of this article or indeed any wider financial aspects.

This information is obtained from sources considered reliable, but its accuracy and completeness is not guaranteed by Anderson Strathern Asset Management Limited. Neither the information nor any opinions expressed constitute financial advice. Investments can fluctuate in price, value and/or income and may return less than the original amount invested. Past performance is not necessarily a guide to future performance. Anderson Strathern Asset Management Limited is authorised and regulated by the Financial Conduct Authority.