Navigating the changing terrain of Capital Gains Tax

Any gain above the CGT allowance is charged at the rate of either 10% or 18% for basic rate taxpayers, and 20% or 28% for higher or additional rate...

Read MoreClicking on either of these links will take you away from the ASAM website. You will be directed to a dedicated portal provided by either Standard Life Savings Limited or Seven Investment Management LLP. Both firms are authorised and regulated by the Financial Conduct Authority.

Login to Standard Life Login to 7IM

The new tax year has arrived. We’ve welcomed 2021/22 and a Budget that brought very little changes to the tax landscape.

Being aware of any tax changes that may affect you is sensible, but we also recommend taking the opportunity to properly review your personal finances now.

We understand that the financial advice marketplace can be daunting with its various products, tax regimes and acronyms. Here we share digestible tips to ensure that 2021 is the year that you get on top of your financial health.

The first step in your financial health check is to create a rainy-day fund. If your boiler broke down over the winter period or if you were made redundant unexpectedly, would you have the funds available to get you through?

We recommend having six months of expenditure in an easy access savings account which avoids the need to encash your invested funds.

Segregate your savings accounts so that each has a clear investment purpose, and avoid dipping into your emergency account unnecessarily. It’s called an emergency pot for a reason.

We recommend starting by setting up a monthly direct debit transferring funds into your emergency pot. Treat it as ‘money spent’ and you will be surprised how quickly you’ll build a healthy level of emergency savings.

We encourage you to review your credit card statements or mortgage agreements to make sure you have a grasp of how much you’re charged each month. We always recommend paying off existing bad debts, especially those with high interest rates, as soon as possible.

Remember: not all debt is bad.

In some cases paying off a debt may be ill-advised. If the debt is reasonably priced (e.g. a competitive mortgage or a student loan), it may be better to invest elsewhere than to pay it off.

Ultimately, the first step is to separate the good from the bad debt. Only then can you decide on the next steps and how this fits into your wider financial plan.

With a better understanding of your debts, you can start planning for the unthinkable and be ready to ask yourself some tough questions.

What would happen if you were to be diagnosed with a life changing illness? How would your household manage if you were unable to work? Are there liabilities that would be left following your death that you’d prefer your family didn’t have to settle using inherited funds from your estate?

Arguably, one of the most important steps towards financial wellbeing is to have the necessary financial protection in place for your family’s future. The peace of mind this can bring is priceless. We can help you create a well-rounded and robust protection strategy.

Balancing individual need with affordability is key. Ongoing costs vary according to individual circumstances, for example age and health. However, protection policies are often more affordable than expected. Remember, the younger you are when you commence a policy, the more affordable the premiums will be, so now may be the time to act.

If you find yourself asking “where did all my money go this month?” it’s time to analyse your expenditure habits. List your monthly expenses, and categorise the necessities and luxuries.

Review your bank statements to add further clarity to your spending patterns. Could some of this money be directed more effectively elsewhere? Our default response is often “I can’t afford to save money into my ISA”. We’d recommend that you drill down to the finer details to really test this assertion.

Did you know that a pension is one of the most tax efficient ways to save for your future?

We recommend considering your contribution levels each month in comparison to your overall affordability. If affordable, then saving money into your pension is one of the most sensible financial actions you can take. Valuable pension tax relief combined with the effects of investment compounding over time can make a significant difference to the value of your pension in the long term. How many other investments offer a 25% basic return before you invest in the markets?

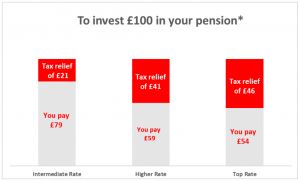

The net returns for Scottish intermediate, higher or top rate tax payers are even more lucrative, with net returns of 27%, 69% and 85% respectively. This chart indicates how much you need to ‘pay’ to receive £100 into your pension.

*Assuming further tax relief entitlement is claimed via self-assessment or directly from HMRC

Also take care to understand which underlying investments your pension is invested in. A pension is an efficient tax wrapper, but as important to the value of your pension in the long term are the underlying investments it holds. Often when you join a new pension scheme you’ll be placed into a default fund, however, nearing your retirement age is a trigger to review your fund selection – your risk tolerance will likely be lower when you become more dependent on your pension.

Remember, pensions are locked away for the longer term, with no access to the money until you have reached the relevant minimum pension age, so other tax efficient wrappers (for example an Individual Savings Account, or “ISA”) should be used alongside a pension if access to your money is a concern.

If taking your first steps onto the property ladder is your aim then you should be equally familiar with Lifetime ISAs (LISAs).

Often the most successful financial planning involves balancing different tax wrappers to provide maximum flexibility, however when it comes to the brass tacks of tax efficient long term investing, a pension really is the number one stop shop.

It’s unusual to think of HMRC as a debtor, however in a number of cases HMRC are the ones who owe us money.

Unless you have elected to salary sacrifice, the payments we make as employees to our workplace pension receive basic rate tax relief at 20%. Effectively, paying £80 into our pension results in a final contribution of £100.

However, Scottish income tax rates differ in comparison to the rest of the UK (for intermediate rate and above tax payers). This means that those who pay income tax at the Scottish rates of 21%/41%/46% (in comparison to the UK rates of 20%/40%/45%) are entitled to reclaim the additional 1% from HMRC.

It’s important to stress that you don’t need to be a big earner to reclaim this entitlement. While higher and additional rate taxpayers should reclaim further relief via their annual self-assessment tax return, intermediate rate taxpayers, who otherwise aren’t a self-assessment taxpayer, simply need to call HMRC to reclaim any entitlement they’re due. So, if you earn more than £25,296 per annum then you are entitled to reclaim further tax relief on your pension contributions of 1% from HMRC. While this is unlikely to be significant, don’t let this money slip away and be sure to give HMRC a call to discuss your situation. It’s your money after all.

Treat the payments made to your investments like any other direct debit and you’re less likely to notice the cost.

Make regular savings part of your financial plan. Time your direct debits around pay dates like you would for your monthly bills. Over time you’ll barely notice these payments leaving your account. Further, your net disposable income (after all direct debits are paid) will be lower which should in theory shape a more disciplined approach to your expenditure habits. We’re all more carefree with our money when our bank accounts are healthier at the start of the month!

As always, affordability is key and take care to only contribute what’s affordable to you.

Inflation is the ‘silent charge’ when it comes to investing. It doesn’t appear on the costs of your investments, but it can greatly impact how your savings and investments compare year on year.

Given the current low interest rate environment, it can be incredibly difficult to make a ‘real’ return on bank account investments. We often perceive money in the bank as a safe haven, and while largely it is (subject to compensation restrictions), your future purchasing power is likely decreasing.

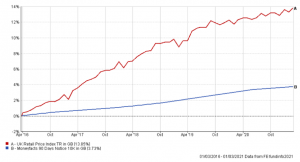

This 5 year performance graph shows inflation growth, as measured by RPI, compared to a 90 day notice bank savings account. The disparity between the two is evident, with bank account deposits (blue line) struggling to keep pace with inflation (red line).

This is not to say that bank accounts don’t have their place. We would only recommend that you invest in the financial markets if you have a minimum investment timeframe of 5 years, and therefore bank accounts can often have their place in shorter investment horizons, as well as building your emergency savings pot. However, holding significant sums in cash is generally not advised, as the erosive effects of inflation can offset any perceived security that comes with retaining sums in cash.

Bank accounts do offer security with our money, but ask yourself at what real cost?

This information is obtained from sources considered reliable, but its accuracy and completeness is not guaranteed by Anderson Strathern Asset Management Limited. Neither the information nor any opinions expressed constitute financial advice. Investments can fluctuate in price, value and/or income and may return less than the original amount invested. Past performance is not necessarily a guide to future performance. Anderson Strathern Asset Management Limited is authorised and regulated by the Financial Conduct Authority.